ACCOUNTING FOR PARTNERSHIP FIRMS

LESSON – 2

PROFIT AND LOSS APPROPRIATION ACCOUNT

In partnership accounting transactions (particulars) two differentiation can be made, that are:

- The transactions that determines the firm’s profit and

- The transactions that determines the profit of the partners.

Here think generally which profit has to be calculated first? Yes, it has to be the firm’s profit as the partners will consider the income as their profit only after taking care of all the dues and payments of the business activity.

From the situation discussed we are supposed to prepare two accounts,

- the account for knowing the firm’s profit and

- the other account for knowing the partner’s profit.

In situations when the firm has not earned any profit the second account need not to be opened as the partners had earned no profit for them after the years business activity, instead they might have to share the losses occurred (if any).

THE TWO ACCOUNTS ARE:

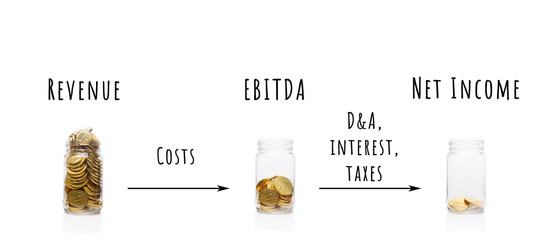

1) Profit and loss account – to know the firm’s profit.

2) Profit and loss appropriation account (exclusively for partnership firms) – to know the partners profit and other agreed shares

1) PROFIT AND LOSS ACCOUNT

It is a statement that shows the financial performance of the firm during an accounting period, it records all the particulars (transactions) that belongs to the firm’s operations. The high these operations are the less the profit of the firm becomes. The result of this statement will show whether the firm has earned a profit or a loss. These items which belongs to this account has to be entered irrespective of the firms profit available or not, so it may even lead to a debit balance (loss).

If the firm has certain amount of profit left in the end after clearing all its dues then it belongs to the partners. The remaining net profit will be taken to another account in order to divide the share among the partners’ according to their agreed terms (partnership deed). This will lead in preparation of another account called profit and loss appropriations account.

SAMPLE FORMAT OF PROFIT AND LOSS ACCOUNT

PROFIT AND LOSS ACCOUNT

for the year ended__________

DR CR

| PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

The particulars that are against the profit (reduces) will be debited to this account. To Net Profit (it has to be transferred to profit and loss appropriation account) | XXXX XXXX TOTAL | By Gross profit (available profit) The particulars that adds to profit will be credited to this account By net loss (will be shared among the partners) | XXXX XXXX TOTAL |

2) PROFIT AND LOSS APPROPRIATION ACCOUNT

Profit and loss appropriation account is prepared exclusively for partnership firms, this is an extension of profit and loss account. The profit (if any) from the profit and loss account after all necessary payments will be transferred (credited) to this account as that profit is the starter for this account, remember if in case there is no profit in the profit and loss account then profit and loss appropriation account will have nothing to start with.

Profit and loss appropriation account will show all the transactions that belongs to the partners. Using the available profit, it will fulfill all the terms and conditions agreed by the partners one by one.

- Interest on capital

- Interest on drawings

- Remunerations / commissions to partners

- Reserves (if any)

IMPORTANT NOTE:

If in case the partners have not prepared any agreement of their own then INDIAN PARTNERSHIP ACT- 1932 will apply.

After fulfilling these terms if any profit is leftover then it will be divided among the partners as they have already agreed. This profit remaining is called “divisible profit”.

SAMPLE FORMAT OF PROFIT AND LOSS APPROPRIATION ACCOUNT

PROFIT AND LOSS APPROPRIATION ACCOUNTfor the year ended__________

DR CR

| PARTICULARS | AMOUNT | PARTICULARS | AMOUNT |

The particulars that are appropriations of partners profit (reduces) will be debited to this account. example: - interest on capital - salary / commission to partners To Divisible Profit (it has to be shared among the partners on their agreed ratio) | XXXX XXXX TOTAL | By Net profit (transferred from profit and loss account) The particulars that add to partners profit will be credited to this account example: - interest on drawings | XXXX XXXX TOTAL |

SITUATIONS TO ANALYSIS AND UNDERSTAND:

a) If there is no profit available from the profit and loss account then there is nothing to start profit and loss appropriation account with.

b) If there is a profit available from the profit and loss account then it will be transferred to profit and loss appropriation account and using that the partner’s terms will be fulfilled.

c) * There is a profit available from profit and loss account but that profit is inadequate to fulfill the agreed terms of the partners. If this is the situation then will profit and loss appropriation account be opened or not?

Profit and loss appropriation account will be opened as there is available profit to start with but the procedure for making settlements to the partners will be different.

PROCEDURE FOR SETTLEMENT

- Calculate the amount of settlement to be made to each partner according to their agreed terms

- The available net profit should be distributed to the partners in the ratio of their appropriations (settlements) as per the calculations made in step 1.

AGAINST AND APPROPRIATION OF PROFIT

According to the two accounts discussed above the transactions can be differentiated into two categories

- Charge against profit - The transactions that affect the profit and loss account. It reduces the firm’s profit.

- Appropriation of profit - The transactions that belong to the partners. All that the partners have agreed for them will be classified under this. It will be shown in profit and loss appropriation account.

CHARGE AGAINST PROFIT | APPROPRIATION OF PROFIT |

| - The transaction amount should be recorded and payed whether the firm earns profit or not | - The transaction amount should be recorded only when the firm earns profit |

| - These items should be recorded in profit and loss account | - These items should be recorded in profit and loss appropriation account |

| - These items are recorded to determine the firm’s profit or loss | - These transactions are entered only after recording all the firm’s payments and other charges that are to be met |

| - They reduce the firm’s profit | - They don’t reduce the firm’s profit as they are recorded only after determining the firm’s profit |

| - Examples: office expenses, rent paid to a partner, partners loan interest etc. | - Examples: partners salary, interest on capital and drawings etc. |

No comments:

Post a Comment